What is your balance sheet? Simply put, your balance sheet is a statement of a business’ financial position at a point in time. It shows what the company owns (assets) and what it owes (liabilities). If you’re a small business owner, you probably come across the balance sheet at your accounting year end, when your accountant sends you one for your records.

In this post, we’re going to go through how to read your balance sheet. If you’re wondering how to read your profit and loss account, we did a piece on that too.

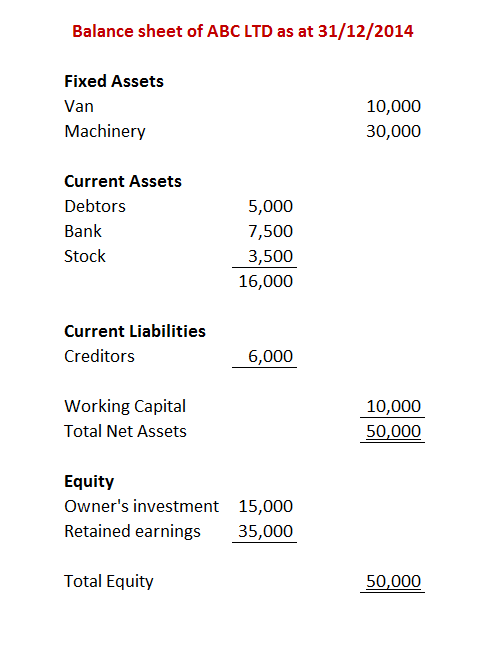

Understanding what the entries on your balance sheet mean will give you a better handle on your accounts and from there, how your business is performing. Below, you’ll see a very simple balance sheet that we’ll use as an example.

Starting from the beginning, our first heading is ‘Fixed Assets’. As we previously mentioned, assets are something that the business owns. Fixed assets are things which the business can expect to have for a longer period of time, such as the company van or machinery used to create products. Your balance sheet should list all of your fixed assets and the amounts they are worth.

If you are unsure about how much they are worth, contact your accountant. Generally, a fixed assets’ worth starts as how much the business paid for it and will reduce at a certain rate each year.

After fixed assets, our next heading is ‘Current Assets’. These are assets which we expect to have for the short term, usually less than one year. The cash that we have in our business bank account is usually found here, as well as any debtors (customers who haven’t paid for a sale yet) and the amount of money that they owe us. These are the two most common entries to appear under current assets in our balance sheet.

If you’re a business that purchases stock to resell or to make goods, the value of stock that you have left over at the end of the year should appear as a current asset too.

The third heading we see is ‘Current Liabilities’. Liabilities are financial obligations that the business must pay but hasn’t yet. Usually you will see creditors appear in this section. Creditors are other businesses who we owe money to on the day that the balance sheet is produced.

Depending on your business, there are a number of the different entries that may appear as liabilities in your balance sheet. They all have one thing in common though, the represent money that the business owes to another party. For example, a liability could be as something as simple as van insurance that is due but hasn’t been paid yet. It’s always a good idea to ask your accountant about liabilities on your balance sheet if you’re unsure of what they are.

We take away our current liabilities from our current assets to get our ‘Working Capital’. In our example balance sheet above, this is shown as 16,000 – 6,000 = 10,000.

Next, we add our fixed assets and our working capital together, shown here as 10,000 + 30,000 + 10,000 = 50,000 in the right column. We call this 50,000 ‘Total Net Assets’ and this shows us how much our business is worth according to our balance sheet.

The next section is ‘Equity’. The total in the equity section must be the same as our total net assets, or put another way they must ‘balance’. This is where the balance sheet gets its name from. In our example, we know that the total equity must equal 50,000 for our balance sheet to balance.

Any ‘Owner’s investments’ made into the business are recorded and shown in the equity section of the balance sheet. In our balance sheet example, this business owner has invested 15,000.

The next entry is ‘Retained Earnings’. Retained earnings is the amount of profit the business has held on to. We use an example figure of 35,000 here. There are a number of different entries that can appear in the equity section. Unless you are extremely proficient at preparing accounts, this is a job for your accountant, although it is important that you at least have a basic understanding of this section.

We can see that our ‘Total Equity’ sum of 15,000 + 35,000 = 50,000 is the same as the 50,000 figure we had for total net assets and our balance sheet has balanced! Your balance sheet should always balance, if it does not, you know that there is something awry somewhere in your accounts.

You might have thought that your balance sheet was complicated, but hopefully after reading through our example you have a better understanding of how it is put together. By using accounting software, you can produce a balance sheet at anytime at the click of a button, it really is that simple. Why not find out for yourself? Take a free trial of Big Red Cloud accounting software today.