4.8 Google Reviews

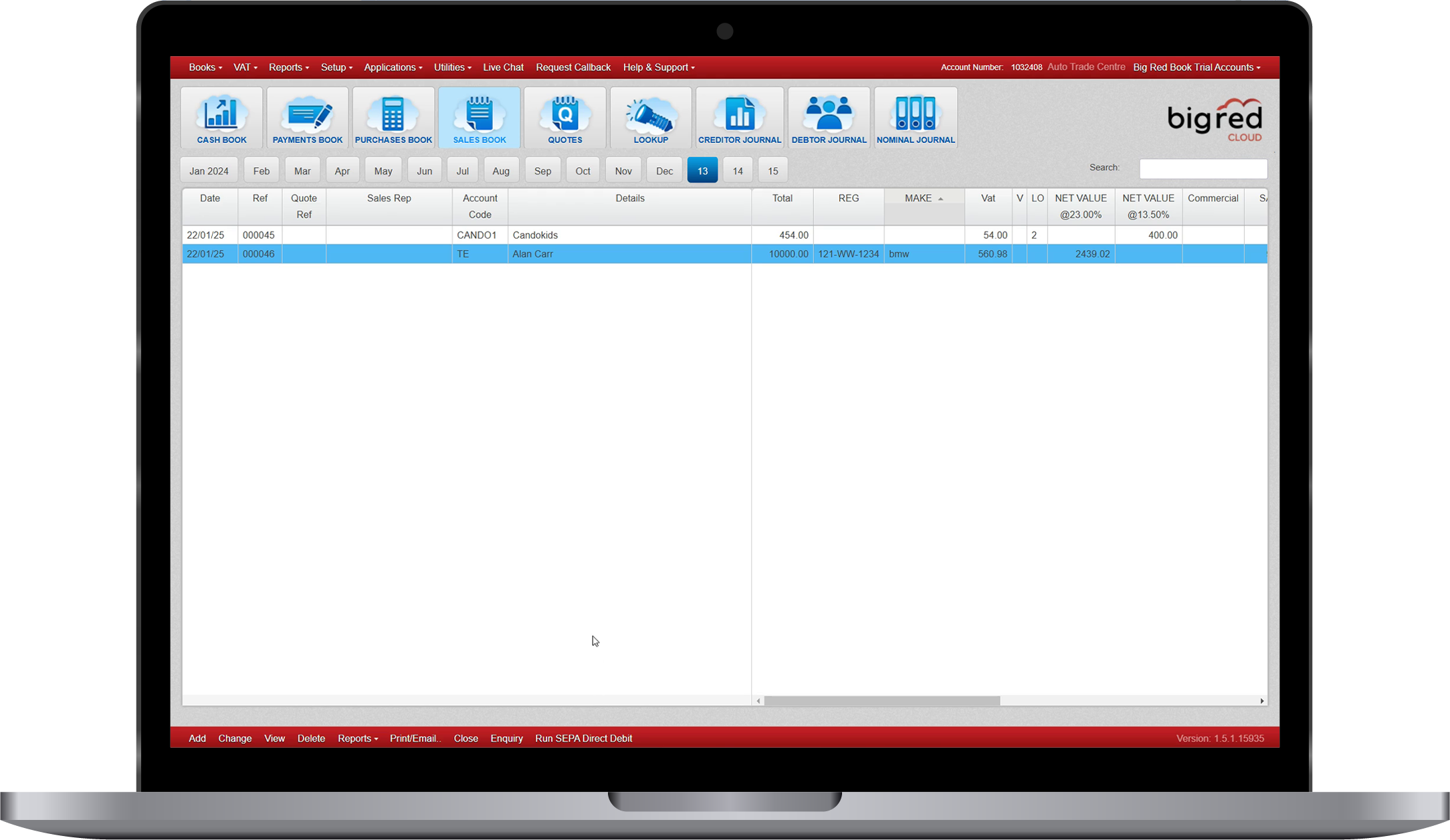

Optimize your accounting with Big Red Cloud’s software, simplifying compliance with HMRC’s Making Tax Digital requirements. Streamline processes to stay organized and enhance efficiency.

Awarded by Guaranteed Irish and the All-Ireland Business Foundation for excellence in service

Understanding Making Tax Digital

Making Tax Digital (MTD) transforms tax administration, making it more effective and easier to comply with. It requires digital record-keeping and digital VAT return submissions via MTD-compliant software. Big Red Cloud provides the solutions to streamline your VAT compliance seamlessly.

Since April 2019, UK businesses with a taxable turnover above £85,000 must comply with MTD for VAT, necessitating digital records and filings. Simplify this mandate with Big Red Cloud’s accounting software, designed to ensure full compliance effortlessly and improve your financial workflows.

Learn more at HMRC.

HMRC Recognised

Achieve HMRC compliance with software fully aligned with all MTD requirements.

Ease of Use

Our intuitive interfaces simplify your move to digital VAT compliance.

Business Owners

The perfect choice for small businesses aiming for easy VAT compliance.

Accountants

Perfectly ideal for accountants managing VAT for multiple clients efficiently.

Master Making Tax Digital Compliance with Ease

Big Red Cloud simplifies MTD compliance with seamless setup, real-time updates, and robust data security, ensuring effortless VAT management.

Seamless Setup

Effortlessly integrate with HMRC systems using Big Red Cloud. Our guided setup makes MTD compliance straightforward and quick.

Real-Time Updates

Automatically receive the latest HMRC updates with Big Red Cloud. Stay compliant without manual checks or software hassles.

Data Security

Big Red Cloud ensures your financial data’s safety with top-level encryption and backups, keeping your MTD submissions secure.

Pricing That Supports Your Business Goals

Explore flexible pricing for new users and best value. Contact us for a custom plan. Simple, effective cloud accounting solutions

50% Off

Your First Year

Get 50% off for your first year. Pay only €30 per month for 12 months then the standard €60 per month applies.

Not sure Visit our FAQs or contact us anytime.

*T&Cs apply. Offer valid for new subscriptions only.

Here’s What You Get with Your Plan

- Import purchase invoices easily

- All accounting features included

- Unlimited users for your team

- Detailed reports and insights

- Local team support always here

- Mobile app with Snap and Send

- Connects with all major banks

Ideal for small businesses and accountants to save money while growing. Contact us at info@bigredcloud.com.

Get a Custom

Quote Today

Contact us for a custom plan that meets your needs. We’ll help you find the right fit for your business.

Not sure Visit our FAQs or contact us anytime.

*T&Cs apply. Offer valid for new subscriptions only.

Here’s What You Get with Your Plan

- Import purchase invoices easily

- All accounting features included

- Unlimited users for your team

- Detailed reports and insights

- Local team support always here

- Mobile app with Snap and Send

- Connects with all major banks

Ideal for small businesses and accountants to practice accounting and boost growth. Contact us at info@bigredcloud.com.

Experience More Than Just Great Accounting Software

As a member of the Big Red Cloud community, you’ll enjoy benefits that support your business by connecting with knowledgeable experts and fellow small business owners

Turbo Inventory

Turbo Inventory by Big Red Cloud: ERP-level inventory features on an accessible cloud platform for small businesses.

Dedicated Support

Our dedicated support team helps you maximize your accounting software for productivity.

Free Training Courses

Access a wide range of free accounting and payroll courses with ETB to enhance skills.

Purchase Importer Add-On

Our Purchase Importer add-on lets you scan invoices directly into your account. Contact us for more details.

Local Expertise

Benefit from a platform tailored for Irish SMEs, providing tools and support to thrive.

Testimonials of Accounting Software for Small Businesses

Hear from small business owners who’ve experienced the benefits of Big Red Cloud’s accounting software designed to simplify accounting and boost success!

Trusted by Thousands

Join thousands of businesses and accountant already managing their finances with confidence

Just getting started with your accounts but unsure of what to do next?

We’re here to help! Whether you have questions about starting with Big Red Cloud or need expert guidance, feel free to reach out via phone, email, or the form below. Our friendly team is always ready to assist and make your experience with our software as simple as possible. For quick answers to common questions, check out our FAQ page—it’s designed to save you time.

Big Red Cloud’s cloud-based accounting software is built for small businesses in Ireland. With user-friendly tools, reliable support, and features tailored to your needs, we help you simplify accounting and focus on growing your business with ease.

Start your free trial

Already have an account sign in here

All You Need to Know About Making Tax Digital

Learn how Big Red Cloud simplifies MTD, ensuring compliance, secure VAT submissions, and easy tax management for your business.

What is Making Tax Digital (MTD) and why is it important?

Making Tax Digital (MTD) is an HMRC initiative aimed at modernizing the tax system by requiring businesses to submit VAT returns digitally through recognised software. It ensures accurate reporting, reduces manual errors, and simplifies the tax process for businesses.

Staying MTD-compliant is essential to avoid penalties and remain listed in HMRC’s directory. It helps businesses focus on growth by reducing the time spent on tax administration and ensuring compliance with the latest regulations.

How does Big Red Cloud help with MTD compliance?

Big Red Cloud’s MTD solution integrates directly with HMRC’s platform, making it easy to submit VAT returns. Our software automates VAT calculations and ensures data accuracy for smooth and error-free submissions.

With features like real-time updates and secure cloud-based access, you can manage your VAT compliance effortlessly. Our active support team is always available to assist you when needed.

Is Big Red Cloud recognised by HMRC for MTD?

Yes, Big Red Cloud is officially recognised by HMRC as a fully compliant MTD software provider. We meet all the requirements for accurate and secure VAT submissions.

Our software ensures that your business stays aligned with HMRC regulations. You can trust Big Red Cloud to deliver a simple and secure solution for all your VAT submission needs.

What do I need to start using Big Red Cloud for MTD?

To start using Big Red Cloud for MTD, you will need:

- An active Big Red Cloud account

- A VAT-registered business

- HMRC MTD login credentials

Our onboarding process is simple, and our support team is here to guide you every step of the way. With our secure and user-friendly solution, you’ll be MTD-compliant in no time.