Ten years in the making, the Companies Act 2014 came into effect on June 1st and standing at 1,448 sections and 17 schedules, and covering more than 1,100 pages of text, it was the largest single piece of legislation ever to come before the Dáil.

The purpose of today’s blog is draw your attention to the Act and also to point out that it will affect all companies incorporated under Irish law, in particular private limited companies.

The new Act does not present an entirely new set of laws as many of the provisions are merely a restatement of the current law. However, there are a number of changes and some new provisions.

According to the CRO office the new Act is being introduced to:

- Modernise and simplify company law

- Reduce administrative burden on business

- Ensure good corporate governance

With that said, what actually does this mean for small businesses? The CRO lists the following:

- It will bring changes in legislation which will affect every company

- All existing Private Companies Limited by Shares will be required to change to a new Company Type

- All CRO forms will change from 1st June 2015

- Old forms will no longer be accepted after this date

- New forms should not be submitted prior to 1st June 2015

- Draft forms are available on the CRO website – www.cro.ie

- Conversion forms will be free of charge

One of the key requirements of the Act is the change of company type. Private limited companies as presented in previous company law are to be phased out with immediate effect. The Act presents three choices:

- To convert to the new simplified type of private company – Company Limited by Shares (LTD)

- To convert to the new company most like existing private limited companies – Designated Activity Company (DAC)

- to convert to another type of company

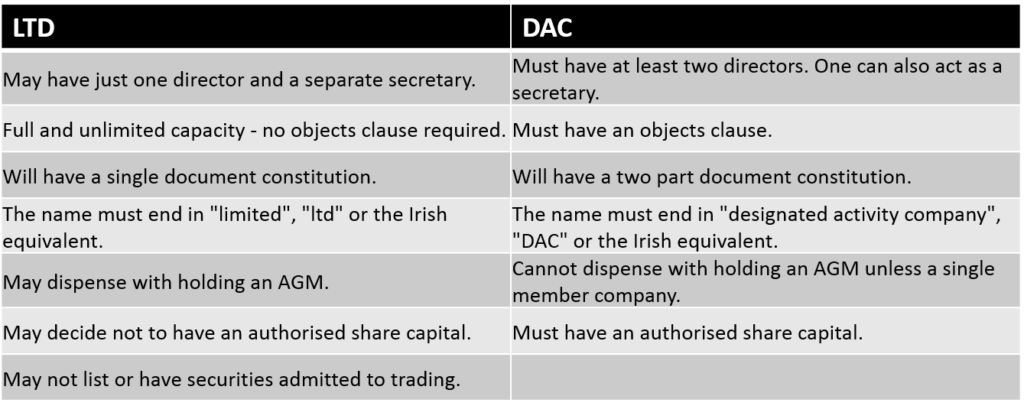

The main differences between LTD and DAC are listed below.

Please check with your accountant to choose the company type most suitable to your particular situation. The new Act allows 18 months from 1 June 2015 until 31 December 2016 to make the required change to either a LTD or DAC. As mentioned above, there is no charge for the conversion process but it is recommended that you make the regulatory change as soon as possible.

Please note: As a company director you should have received a written communication from the CRO detailing the effects of the new Act. Please find the a copy of that communication here.