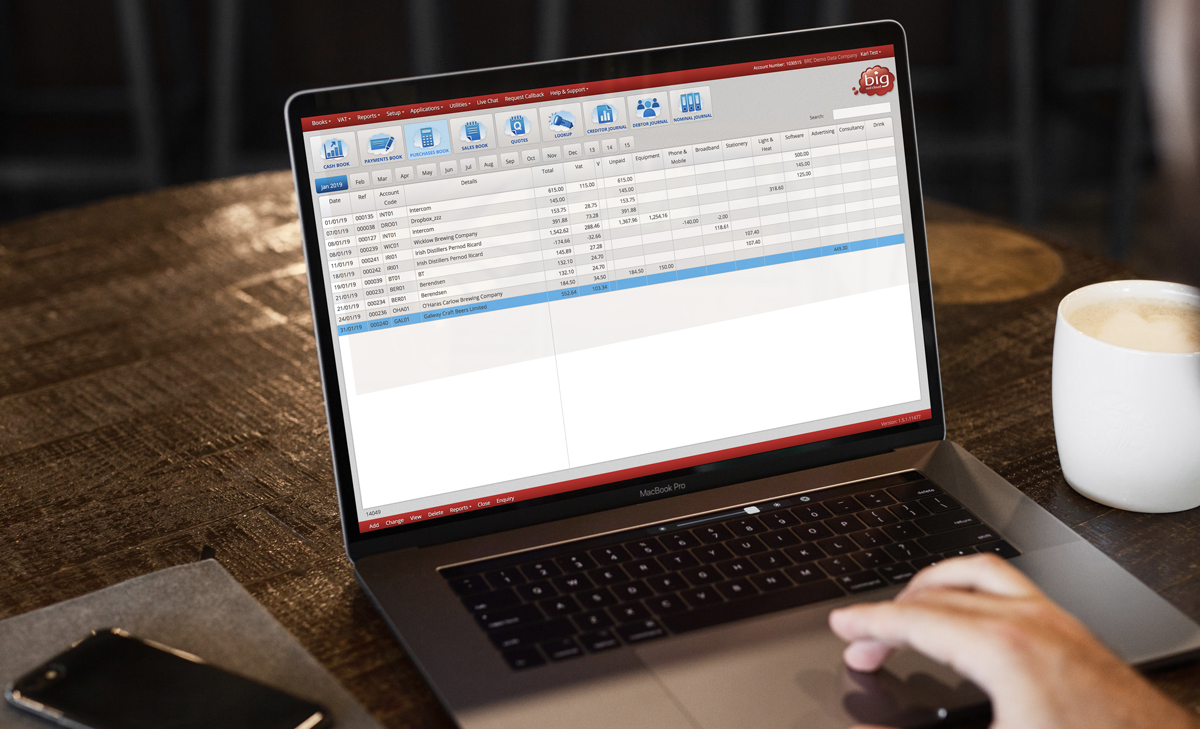

There are many benefits to small businesses in moving away from all manual accounting processes. The most obvious is that using cloud-based bookkeeping allows financial information to be accessed any time from any web-enabled device and makes it easier to manage debtors and creditors.

For example, Big Red Cloud’s sales app allows users to create and send invoices from any Android phone or tablet or an iPhone or iPad.

The ability to track income and expenditure from any location via your mobile device means better cash flow management and a better relationship with your bank. Instant access to financial information allows you to check your balance in real time and apps that scan and upload Invoices make it easier to monitor costs.

Perfecting your payments

Using a cloud accounting systems enables sales invoices to be raised within the system and sent directly to customers. Making it easier to get paid quicker.

Savvy businesses no longer create invoices separately and input the details into their accounting system, saving time and reducing the potential for manual errors.

Digitising the invoicing process also makes it easier to chase outstanding invoices by allowing reminders to be sent automatically. Linking the system to your bank account is as easy as downloading your transactions directly from your bank account using the new PSD/2 rules to import directly into your accounting system, ensuring that time is not wasted chasing invoices that have already been paid or inputting payments that up to now had to be manually inputted.

Don’t leave data to chance

The cloud has proven to be a reliable and secure means of accessing data. However, businesses should take the time to understand how their financial information is stored and test back-up systems to ensure they are able to retrieve their data in the event of the service becoming unavailable.

It is good practice to check how long a service provider has been in business, the size of its customer base and whether it has had any issues with data security or availability in the past. Businesses should also find out where the data is hosted and do similar due diligence on the company hosting the data.

The best way to ensure data is stored securely and remains accessible is to work with a reputable cloud-based accounting solution provider such as Big Red Cloud to reduce your dependence on in-house systems. The majority of data breaches are caused by disgruntled employees or lax cybersecurity practices.

Human touch still needed

Small businesses in particular would be advised to explore cloud-based accounting solutions as soon as possible because eventually all businesses will be required to keep their records digitally. The technology has never been more user friendly, but that does not mean that we are moving towards a future of automated accounting.

Businesses place a lot of trust in financial technology – when a piece of software produces a number the user will almost always assume it is accurate. There will always be a role for the accountant (whose role has evolved from preparing returns to offering assurance on tax matters) to consider whether this number is actually correct.