Your profit and loss account contains a wealth of information about your business but how do you make sense of it? Your profit and loss account shows your business’ revenues and expenses during a particular period and how revenue is transformed into net profit.

As a business owner you rely on your accounting software and your accountant to produce and interpret this report. Here’s the crux of the matter; it’s really important that you have a basic understanding of your P & L so that as your accountant is providing you with in-depth insights into your business performance, you are able to understand and action those insights in a meaningful way.

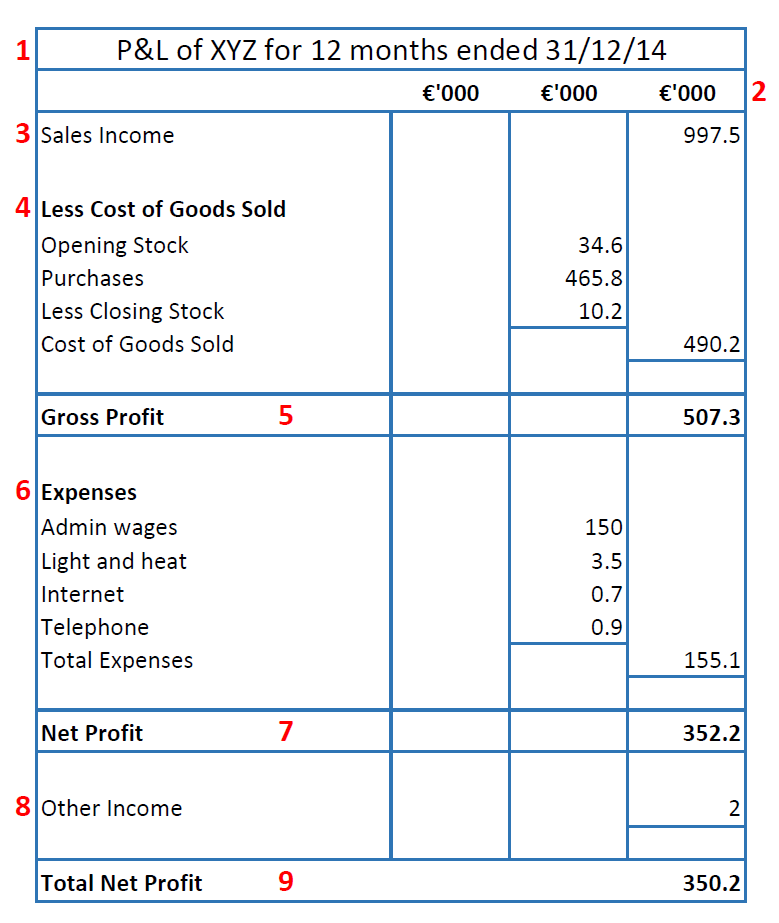

We’ve outlined a standard profit and loss statement below, so let’s talk through the different points that you need to know about.

1. The heading at the top of the statement informs us that this is a P & L for XYZ LTD for a certain amount of months up until a certain date.

Your accounting software will automatically include the correct values in this line depending on what period of time you run the profit and loss report for.

2. This line shows what currency values are being used. In this example we can see that the accounts are being prepared in Euro. The values are also in thousands of Euro as outlined by the three zeros. This is common practice in order to make accounts easier to read.

3. Sales Income shows the sales that have been recorded for the accounting period, exclusive of VAT. This figure can also be known as revenue.

4. Cost of goods sold are the direct costs attributable to producing products that the company sells. In this business example it is mainly made up of purchases as the company buys in supplies and resells them. If this were a manufacturing business the cost of goods sold may be more detailed in order to take into account the materials used and the labour hours required to produce goods for sale.

In a service business this section may be called cost of services provided.

5. Gross Profit = Sales – Cost of goods sold. Gross profit represents the money available to pay expenses and other running costs.

6. Expenses are those costs incurred by the business but are not directly related to producing the goods or services you sell. They may be known as overheads or by other headings. Generally, the largest expense that a business will have is wages/salaries.

7. Net Profit = Gross Profit – Expenses. This is the profit left over after all costs, both direct and indirect, have been paid by the business.

8. Other Income is exactly what it says on the tin, income other than that from your sales. For example, you could have other income if you sublet part of your office space to a tenant and receive rent. Generally, your accountant will be able to advise you should you be fortunate enough to receive any other income.

9. Total Net Profit = Net Profit + Other Income. This is the profit that your business has made during the accounting period.

We hope that this blog post helped you to better understand your profit and loss account. If you’re looking for accounting software that can make your profit and loss as easy as possible. Big Red Cloud provides online bookkeeping software that will make preparing your accounts simple. Why not try our free trial and see for yourself?