How to Prepare a Cash Flow Forecast

Cash flow forecast is a pretty important topic, and you’ll have come across some of the previous stuff we published. In fact, we wrote a whole guide about it. Why have we written so much about cash flow? It’s a good question, and the answer is vital to the survival of all businesses. We think that’s a pretty important topic, so we’re covering it in as much detail as possible.

A quick reminder, cash flow is the movement of money into and out of your business. You must always have more money coming into your business than you do going out so that the business can pay the bills it owes and continue to trade.

What is a cash flow forecast?

Referred to as either a cash flow forecast or cash forecasting, this is the process of working out the future flow of cash that comes into and goes out of your business. It’s a complete overview of your finances that gives you financial insights over any given period.

While it remains an estimation, the more data you use the more accurate your cash flow forecast. That’s only good news when you’re struggling to manage your working capital. Looking at your expenses and your income, a cash flow forecast will help you make more informed decisions about funding, investments, and how best to use your profits.

Preparing a cash flow forecast

In this post, we will talk about preparing a cash flow forecast. Like how most good things start with a good plan, a good cash flow forecast is the foundation of good cash flow management. Doing regular forecasts will let you see any sticky financial situations ahead of time and give you the necessary notice to react. We can’t stress how important that is – cash flow forecasts could save your business. So how do we prepare one?

The first thing you have to do is pick the time you want to forecast for and break that time down into months. We recommend doing regular forecasts for a period of a few months. Things change regularly in business, and a forecast that you prepared 12 months ago probably looks a lot different to what is happening now. Once you have decided on your time period, we can lay out our forecast.

You can use simple spreadsheet software such as Excel to produce a forecast in a matter of minutes. If you’re using accounting software like Big Red Cloud, this will be even simpler. Ultimately, your cash flow forecast will show estimates of the money coming in and the money going out for each month, leaving us with the money we have left over. We want the estimates to produce our forecast as accurately as possible.

Cash flow forecast example

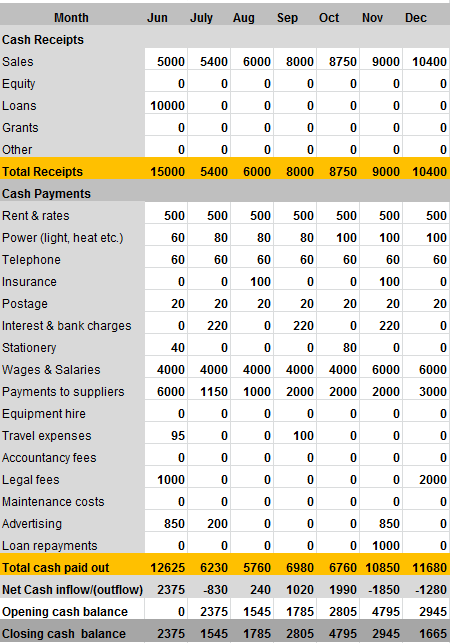

Below is a cash flow forecast example that has been put together for six months. Have a look through it before we outline the details underneath.

We can see in our example that we have prepared the forecast for six months, from June to December. The first section is called Cash Receipts. This section determines how much money we should have come into our business over the next few months.

Understanding your income

Our primary means of receiving money is through sales. You should be able to input reliable estimates for your sales figures over the coming months based on historical figures or invoices you may have already sent out that aren’t paid yet.

Apart from sales, we may receive money into our business by other means, such as equity (investment), loans or grants. In this example, this business is a start-up, and the owner will take out a loan for €10,000 from the bank in June to help with set-up costs. That’s why we can see it recorded as a cash receipt in the first month of our forecast because that money will come into the business. The owner has estimated sales figures for the next six months, showing a gradual increase as the business establishes itself. This kind of financial forecasting relies on understanding your income.

Total receipts and outgoings

Our Total Receipts (shown in yellow here) is the sum of all the money the business can expect to receive for that month. Our next section, called Cash Payments, will list all of the outgoings we expect the business to have in the coming months. Some of these, such as telephone costs, may be a flat monthly bill.

On the other hand, we may have one-off costs that we need to be aware of, such as legal fees when the company is first set up or paying our accountant at the end of the financial year.

Generally, wages will be the largest and most consistent outgoing from your business. Purchases you make from suppliers will play a significant role in your outgoings too. Our cash flow forecast example shows that many supplier payments are made in June as the business owner buys what he needs to launch the business and start selling. It’s also estimated that these costs will be higher in December as more stock may be required to meet the demand of the Christmas period.

Net cash flow

Adding up all of the outgoings we expect to have in a month results in our Total Cash Paid Out (shown in yellow). By subtracting this from our Total Cash Receipts, we can see exactly how much cash we have left in the business after each month. This is called a Net Cash Inflow, or potentially how much of a cash deficit we could have for that month known as a Net Cash Outflow.

Having a net cash outflow for an extended period means trouble for our business as it will have to rely on the cash reserves we’ve already built up over the previous months to survive.

In our cash flow forecast example, we can see a net cash outflow for November and December. The wages are higher than they were previously as the business owner wishes to hire another staff member in the run-up to Christmas. However, it appears that the business can’t afford it as it results in a negative net cash outflow, and the business is surviving on the opening cash balance for those months.

The business owner may have to reconsider their intention to hire more staff. Alternatively, they might consider hiring that new team member while adopting some stricter cost reduction strategies.

The opening cash balance

So, what is the Opening Cash Balance? Our opening balance is how much cash the business has on hand at the start of each month. Usually, this is the business bank account(s) balance. As you can see in our example, our opening cash balance is 0 because this is a brand new business.

However, in July, our opening cash balance is the Closing Cash Balance from the previous month, and so on for the rest of the months in the year. To get our closing cash balance for a given month, we add our opening cash balance to the net cash inflow/outflow. This gives us a good estimate of how much money the business has at its disposal at the end of the month.

Protect your business with a cash flow forecast

Predicting your cash flow should be a priority for every business owner. It’s the easiest way to get financial insights that make managing your overall cash flow much more straightforward. It can be an early warning system, too, highlighting when there may be seasonal cash flow problems, which will lead to much more proactive decision-making.

You can make decisions based on real-world facts with a cash flow forecast. It takes the guesswork out of managing your business in the months and years ahead.

So what does your cash flow forecast say about your business? Why not prepare one and make sure you get the best possible picture of the financial health of your business. If you’re not sure about the best way to create your cash flow forecast, talk to the friendly team at Big Red Cloud about our free trial. Our cloud-based accounting software takes the headache out of managing your money.