Using Method 1 (without Allocations).

An additional report is displayed on the VAT Menu – VAT on Cash Receipts. This report is similar to the VAT3 report but the Sales are taken from the VAT Analysis in the Cash Receipts Book rather than Sales Invoices. The report is formatted to make it as easy as possible to fill out your VAT form, i.e. the totals to be entered in boxes T1, T2 etc. of the VAT3 form are separately identified.

Using Method 2 (with Allocations).

VAT on Receipts are only included in a VAT submission when they have been allocated to a Sales transaction. Therefore all cash receipts should be allocated before making a submission.

When a return is submitted, all Receipts included in that return are flagged with the ‘Return Code’ assigned to the VAT submission and those transactions cannot be changed.

To produce this report at the top menu select VAT / VAT on Cash Receipts.

Select A Report Panel.

Sales Details and Summary reports can be printed to show what transactions have been or will be included in a VAT Return.

The VAT3 Summary Report is formatted to make it as easy as possible to fill out on your VAT form, i.e. the totals to be entered in Box T1, Box T2 etc. of the VAT3 form are separately identified. The report also includes a table of purchases and sales information formatted so as to assist in the preparation of your Annual Return of Trading Details.

Period Panel.

Select the period of the report.

Please Note:

While transactions after ‘To’ period will not be included in a preview report, all unsubmitted allocations up to that period will be included in preview reports. For this reason care must be taken when making a first submission to ensure that old transactions which may already have been included in a VAT Return are excluded. This may involve making an initial ‘fake’ submission to pick up these transactions.

Action Panel.

Preview A New Return.

When this option is selected the Reports will include all unsubmitted transactions up to the ‘To’ period selected.

Submit A Return.

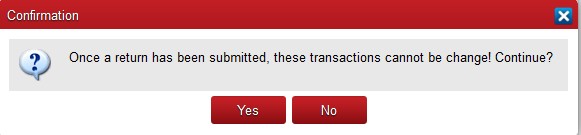

Select this option with VAT3 Summary Report and enter a Return Code. When you then click on Print you will be given the following warning:

If you are happy that the transactions are correct you can click on Yes.

Review An Existing Return.

Select the Return Code for the submission to be reviewed and the Periods for that return.

Print the reports to be reviewed.

Undoing a Cash Accounting VAT Return.

If you wish to cancel a submission there is an option to Reverse VAT on Cash Receipts VAT Return in Utilities Menu. This option should used with caution.