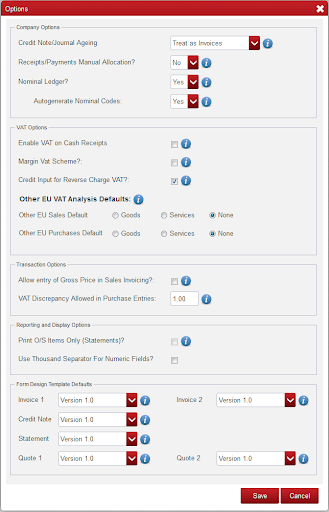

Company Options #

Credit Note/Journal Ageing

Treat as invoices will age your Credit Notes and Journals according to the period, they are entered in.

Treat as payments will age your Credit Notes and Journals by reducing the oldest balance on the account.

This is only of relevance if “Receipts/Payments” manual allocation is set to null below.

Receipts/Payments Manual Allocation?

Alternating between allocations On/Off can cause inconsistencies in your allocations pacifically discounts.

Once allocations has been switched on and allocations are performed, it is not impossible to switch allocations off again.

Where dormant customer suppliers exist, it is possible switch allocations on.

You should be sure that you need to change this setting before changing it.

Nominal Ledger?

Select NO if you do not wish to operate the nominal Ledger. It will operate in the background, unseen by the user, using a default set of Nominal Accounts.

Select YES if you wish to operate the Nominal Ledger, which will enable you to customize your Nominal Accounts and to run Nominal Reports such as trading Profit & Loss, Trial Balance and Balance Sheet.

Autogenerate Nominal Codes:

Select YES if you want Nominal Accounts to be created automatically without customization.

Select NO if you wish to customize your own Nominal Accounts.

Important Note: it is always important that you have your accountant review your Nominal Accountants.

VAT Options: #

Enable VAT on Cash Receipts

Select NO if you calculate VAT on invoiced sales.

Select YES if you calculate your VAT on basis of receipts from customers during a VAT period rather than an invoiced sales.

Margin VAT Scheme?

Assist with calculating VAT based on the difference between the sale price and the purchase price of goods.

Credit Input for Reverse Charge VAT?

Purchases entered as ‘Reverse Charge VAT’ are automatically included in the T1, VAT on Sales, section of the Standard VAT report. Ticking this will also include them in T2, VAT on Purchase.

Other EU VAT Analysis Defaults:

A default other EU VAT analysis can be selected for sales and purchases. This is the other EU VAT analysis that applies to the majority of other EU Sales and other EU Purchases and will be presented to you by default throughout your use of the application.

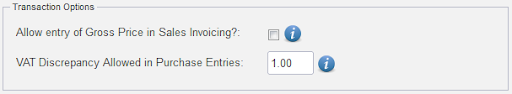

Transaction Options #

Allow entry of Gross Price in Sales Invoicing?:

Select this if you require a Gross Price field on invoice line items, allowing you to enter price inclusive of VAT.

VAT Discrepancy allowed in purchase entries:

Enter the VAT calculation discrepancy that is acceptable, when entering purchase transactions.

Reporting and Display Options: #

Print O/S items only (statements)?

Select this if receipts payments manual Allocation is set to YES above.

Use Thousands Separator for numeric fields?

Select this to input a separator for numeric fields.

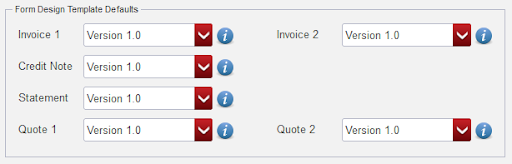

Form Design Template Defaults: #

Invoice 1

The selected version will be used as the Default Template for type 1 Invoices.

Invoice 2

The selected version will be used as the Default Template for type 2 Invoices.

Credit Note

The selected version will be used as the Default Template for Credit Notes.

Statement

The selected version will be used as the Default Template for Statements.

Quote 1

The selected version will be used as the Default Template for type 1 Quotes.

Quote 2

The selected version will be used as the Default Template for type 2 Quotes.