Preparing for a bank reconciliation #

When you receive a bank statement and prior to starting the reconciliation in the accounting software you should:

- Ensure that your have entered into the Cash Payments Book the details of all lodgements made, and that your have entered into the Bank Payments Book details of all cheques etc. written. Normally the sources for these entries should be your lodgement slips and cheque stubs rather than the bank statement itself. The reason for this is that your records should represent, as far as is possible, an independent check of items that appear on the statement.

- Scan through the bank statement to identify items which are not likely to already be in your records. Details of bank fees and charges and possibly direct debits are typical examples. Update your records with the necessary information, e.g. details of bank fees and charges should be entered into the Bank Payments Book.

Ticking Items Cleared Through the Bank.

The first task in doing a bank reconciliation is to identify outstanding items, i.e. transactions you have entered in your records but which have not yet appeared on a bank statement. The importance of this lies in the fact the difference between our balance and the statement balance should equal the total amount of outstanding items. The simplest way to do this is to mark-off or ‘tick’ those entries that do appear on the bank statement.

- Select Lookup/Bank Account or Setup/Bank Account.

- Highlight the bank account required and double click, click on the Ledger button.

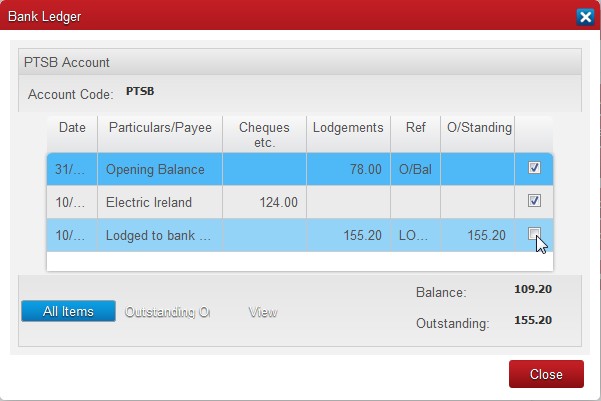

- The screen you should be looking at will be similar to this:

Note the following:

- The Balance figure, near the bottom-right, represents the bank balance according to your records. It is calculated as the opening balance, plus all lodgements entered, minus all cheques etc. entered.

- Displayed in the middle of the screen is the list, in date order, of all transactions you have entered which affect this bank account. Each item that features on the bank statement should also appear on this list.

You should now take each item in turn from the bank statement and find it on the list on the screen. You can scroll through the list using the arrow, Page Up and Page Down keys. When you have found the item on the screen you should check that its debit/credit amount is the same as it is on the bank statement. You can then ‘tick’ it on the screen to indicate that it has cleared through the bank. You highlight the line and then either pressing the space-bar on the keyboard or double-click on it. As you do this the amount will be removed from the column headed O/Standing and a ‘tick’ will appear in the rightmost column on the screen.

Note: To avoid overlooking items on the bank statement you should, as you tick items on the screen, also tick them on the statement itself.

Note: The Outstanding figure, underneath Balance near the bottom-right, represents the total of all unticked items. This figure changes as you tick items. However, the Balance figure does not change as you tick. This is because whether or not an item has cleared through the bank does not

affect what the balance is according to your records; only entering details of lodgements or cheques etc. can do that.

All Items Or Outstanding Only.

When you look up the Bank Ledger the list displayed will contain all the bank entries you have created since the beginning of the Financial Year as well as any items from previous years that were not reconciled before the year-end. All the previously ticked items will be displayed as well as those those still outstanding. To avoid looking at all items you can click on the ‘Outstanding Only’ button to display only unticked items. Only items ‘unticked’ at the start of the session will be displayed.