Using Method 2 (with Allocations), Cash Receipts are entered as usual and allocated against Sales Transactions in the accounting software.

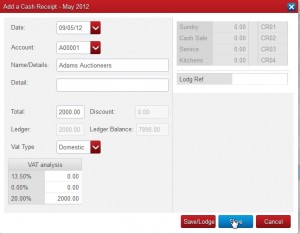

Using Method 1 (without Allocation), details of receipts from customers are entered in the Cash Receipts Book. If you have answered Yes to the ‘VAT on Cash Receipts?’ option during setup, a VAT Analysis panel is displayed in the Cash Receipt entry screen, as below:

When entering a Cash Receipt you must analyse the Gross amounts (i.e. inclusive of VAT) in the VAT Analysis. The sum of the amounts entered under the various VAT rates should therefore equal the amount entered as Total earlier on the screen in the accounting software.

Note for Nominal users: As all the figures used in the VAT Analysis in the Cash receipts book are gross, postings made to a Nominal account are therefore also gross and the VAT control Account is not affected. To post the VAT element to the VAT Control Account a Nominal Journal adjustment will have to made.