Debtor and Creditor Journals are direct adjustments to the balance on a Supplier’s or Customer’s account without making a normal entry in one of the day books. An example would be where you have a Customer’s account with a small balance which you wish to write off in the accounting software. This can be done by making a Debtors Journal entry. Most adjustments to a Supplier’s or Customer’s balance will be made by the issuing of invoices or credit notes by your Supplier or by you and these should be entered in the Purchases Book or Sales Book in the usual way. However, the following are examples of situations where an entry to a Creditors or Debtors Journal may be necessary in the accounting software:

- Where adjustments to your Purchase Ledger or Sales Ledger balances have been advised to you by your accountant as part of your annual audit.

- Where the writing-off of a balance due has been agreed with a Supplier or Customer and no credit note has subsequently been issued.

- Where you have agreed a reduction in a Creditor’s (Supplier’s) balance as payment for goods supplied by you to them. (This is often referred to as a ‘contra’ or ‘trade-in’).

- Where a debt due to you is unlikely to be paid but you may not wish to issue a credit note to your Customer.

Note: The examples given above in no way constitute formal advice. In any given instance you may wish to consult you accountant before proceeding to adjust a balance using these routines.

To Make Entries In The Creditors/Debtors Journal:

- Click on the Debtors or Creditor Journal icons or in the Books menu select Journal Adjustments, and then either Creditor Journals or Debtor Journals.

- On display is the Creditors Journal or Debtors Journal, the formats of which are identical.

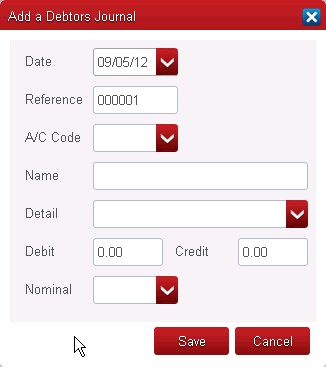

- To begin entering a transaction either click on the Add button or press the A key. A new window entitled Add a Creditors Journal or Add a Debtors Journal is displayed.

You can now fill in the blank entry form with the details of each transaction.

Notes On Creditors/Debtors Journal Entries.

Month.

Either accept the current month which is on display or pick-and-click whichever previous month to which this Journal transaction relates.

Date.

Enter transaction date. As described earlier, the program attaches more importance to the month of entry than it does to the date of the transaction.

Reference.

On display is the ‘next sequential number’ as generated automatically by the program. (The Creditors and Debtors Journals each have their own sequences). Unless there is a good reason for not doing so, you should simply accept this ‘next number’ and move on. (If you start to use the Big Red Cloud® midway through your Financial Year and you have already made Journal adjustments, then you may wish to overwrite the displayed number in order to ‘reset’ the sequence).

A/C Code.

Enter either the Supplier Code or the Customer Code of the company whose account you wish to adjust.

Name.

The relevant Supplier’s or Customer’s name will automatically display in this box.

Detail.

Type in whatever you choose (maximum 40 characters) to describe the transaction or pick-and-click an Abbreviation from the drop-down list, then move on.

Note: Abbreviations are added through the Lookup facility which has its own icon/button. For Creditors/Debtors Journal transactions a useful narrative to have available (in Abbreviations) would be “Balance written off”.

Debit.

Enter the amount by which you wish to debit the account.

- If entering a Creditors Journal, debiting the account will reduce the amount you owe the Supplier.

- If entering a Debtors Journal, debiting the account will increase the amount the Customer owes you.

Credit.

Enter the amount by which you wish to credit the account.

- If entering a Creditors Journal, crediting the account will increase the amount you owe the Supplier.

- If entering a Debtors Journal, crediting the account will reduce the amount the Customer owes you.

Note: A single transaction must contain either a Debit entry or a Credit entry; it cannot contain both.