As part of the July Stimulus Package the Minister for Finance has announced a temporary reduction in the standard rate of VAT for a six month period. On 1 September 2020, the standard rate of VAT will change from 23% to 21%. The rate is due to revert to 23% with effect from 1 March 2021.

For most transactions between VAT registered traders, it will be “cash neutral”; however, there are a number of administrative issues to take into account.

Invoices

- On or after 1 September 2020 VAT invoices issued by a VAT registered person (who is not on the cash receipts basis) to a VAT registered person, a public body or a business carrying on a VAT exempt activity should show VAT at the new 21% rate. This is so even if the goods or services were supplied before this date.

- A trader on the cash receipts basis who is required to issue a VAT invoice to another VAT registered person should show the VAT rate which applies on the date of the supply, not on the date of receipt of payment.

- Goods or services which are actually supplied to consumers prior to 1 September 2020 are taxable at the 23% rate even though they may be invoiced after 1 September 2020.

To implement these changes in Big Red Cloud – Firstly add a VAT Rate of 21%

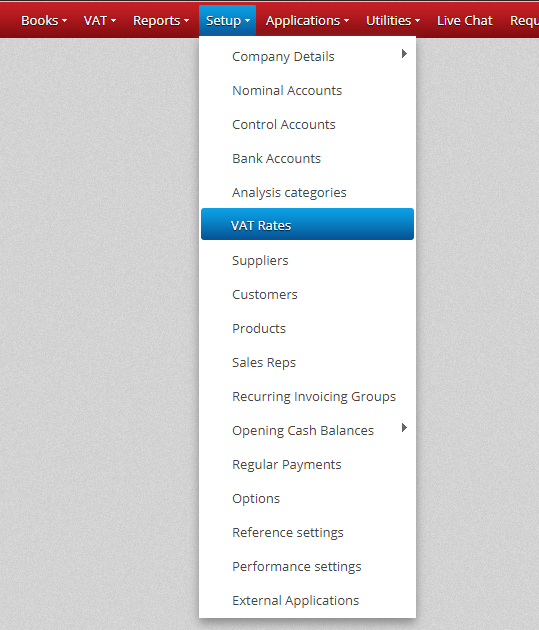

Go To Setup – VAT Rates

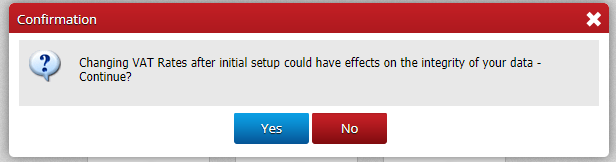

and say yes to making the change.

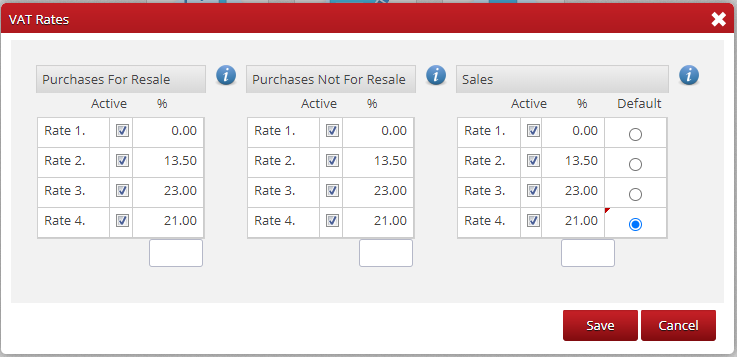

Once on the next screen, add the new VAT Rate:

Set it as default if you wish, and Save

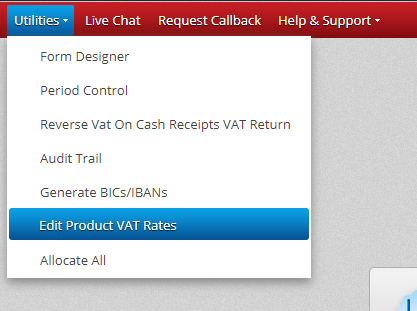

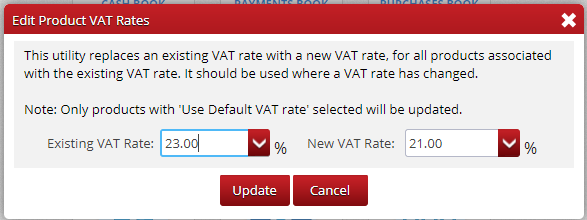

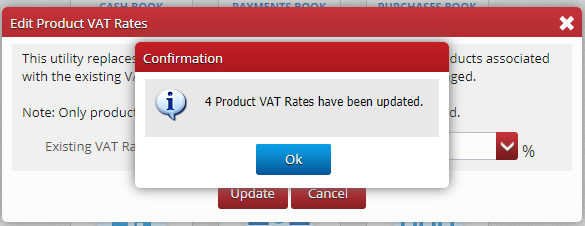

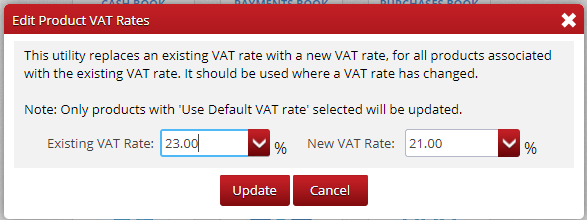

Next, go to Utilities – Edit Product VAT Rates

Set the existing rate to 23% and new rate to 21%

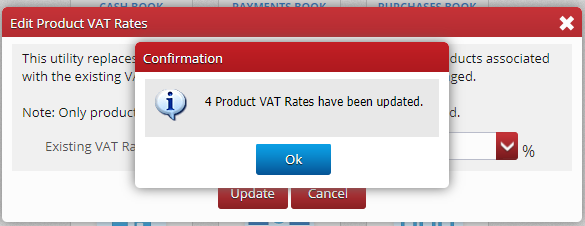

Click on Update, and then click on OK when done.

VAT Rate Changes For Recurring Invoicing: #

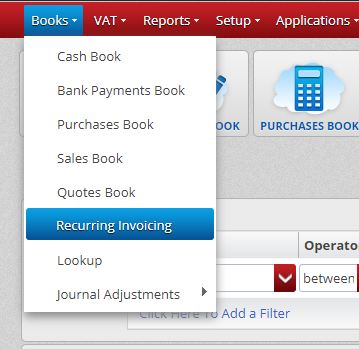

Go To Books – Recurring Invoicing

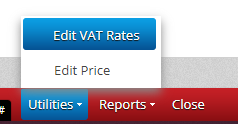

On the bottom of the screen, choose Utilities and then click on Edit VAT Rates

Set the existing rate to 23% and new rate to 21%

Click on Update, and then click on OK when done.