In order to enter some transactions in Big Red Cloud accounting software, you must setup at least one VAT Rate. A VAT Rate of zero should be setup for transactions not subject to VAT in the accounting software.

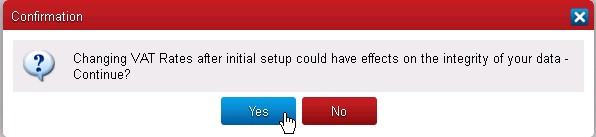

To Setup VAT Rates select Setup / VAT Rate from the top menu. A warning screen is displayed:

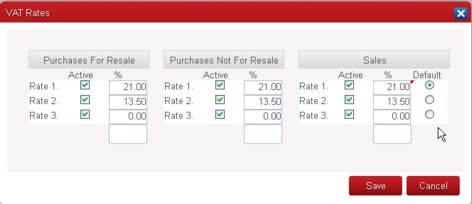

Click ‘Yes’ to continue; a screen similar to the one below is displayed:

Some businesses may not have any Purchases for Resale, e.g. a Service Business.

Enter the Purchases and Sales VAT Rates used in your business. Tick ‘Active’ to make a rate available for data entry. For Sales you can also select a Default VAT Rate; this is the rate Sales Invoices will default to.

Changes to VAT Rates. #

As a general rule VAT Rates should be added rather than changed.

An existing rate can be changed if you are sure that there are no transactions in the system using that rate, e.g. after the Year End has been run when Allocations are Off.

When VAT Rates change you should add the new VAT Rate rather than change an existing one. This is particularly important when a change occurs after the start for your Financial Year or when Allocations is switched On as there may be transactions in the system that require the original rate.

When a VAT Rate is no longer in use uncheck ‘Active’ so it is not available when entering data.

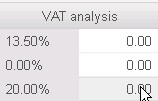

For example the 21% rate is unchecked below and does not appear int the VAT Analysis section of Sales transactions.