The Standard Vat Report calculates data for the VAT3 Report from the Sales Book and Purchases Book for the period selected.

The normal formula for calculating VAT payable for a period is:

Total VAT collected on sales for the period

minus

Total VAT paid on purchases for the period

Important Notice.

The owners, partners or directors of a business are solely responsible for the making of correct VAT returns to the Revenue Commissioners. Big Red Cloud® accepts no responsibility for errors arising from the use of this program for the calculation of VAT liabilities.

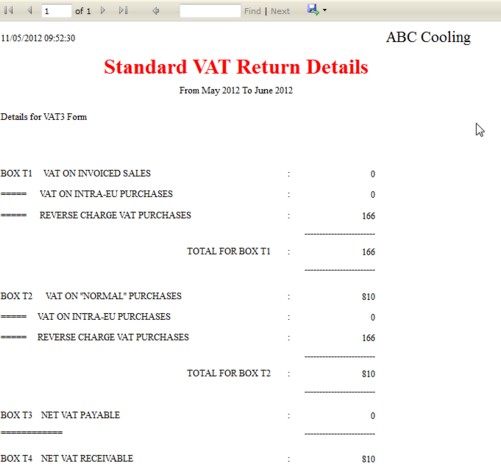

The Standard VAT Report (Republic of Ireland).

The report is formatted to make it as easy as possible to fill out your VAT form, i.e. the totals to be entered in boxes T1, T2 etc. of the VAT3 form are separately identified. The report also includes a table of purchases and sales information for the Annual Return of Trading Details.

To produce this report:

- Select VAT from the top menu in the accounting software.

- Select Standard VAT Calculations.

- On display in the box entitled From will be the first month of your Financial Year. Accept it or change it according to which should be the start month for your VAT report.

- Accept or change what is shown so as to reflect which month should end the period for which you want to produce the VAT report.

- Click on Display to display the report.

It is recommended that you file the report with your copy of the VAT return. It is also advisable to print and file a copy of the Purchases Book VAT Details and Sales Book VAT Details reports for the period in question. These will show the basis for your VAT return and will be useful to your accountant or in the event of a tax audit.